House Rent Deduction For Income Tax . Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. Income tax is a tax payable on all income. But before you decide to rent out your home, it’s important to. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation. This means you need to pay rental income tax on the rent you earn. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). The rent that you receive from renting out your property in singapore may be subject to income tax.

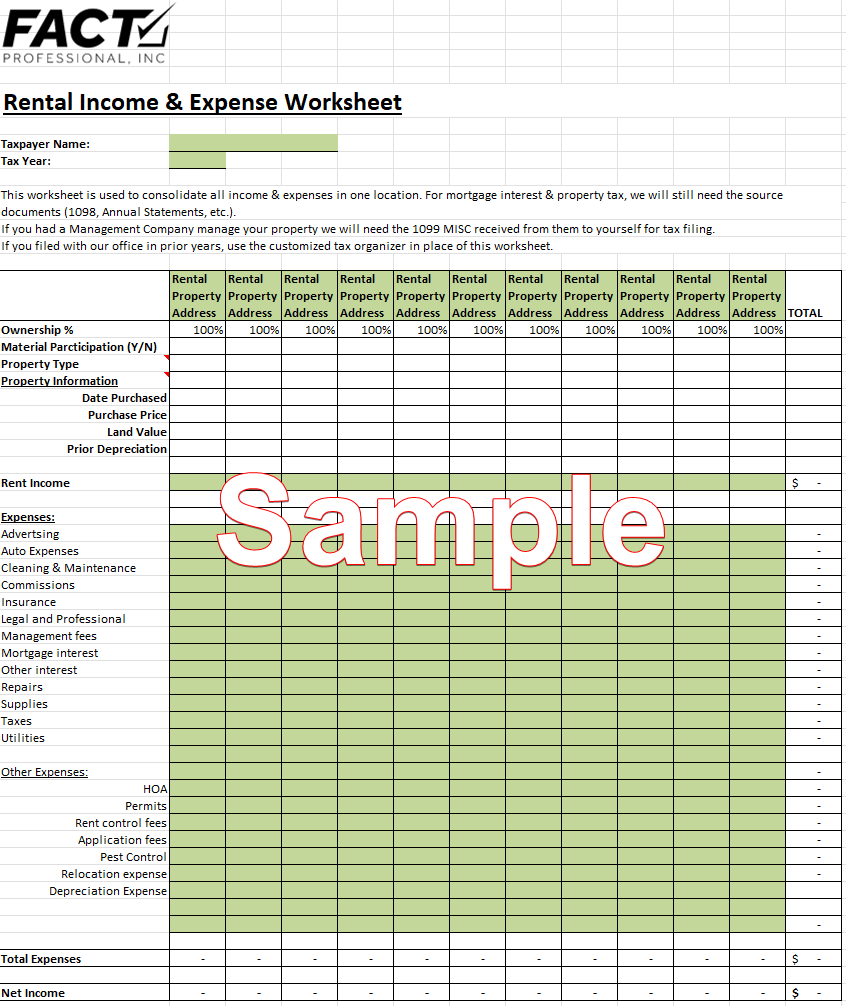

from factprofessional.com

But before you decide to rent out your home, it’s important to. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). The rent that you receive from renting out your property in singapore may be subject to income tax. This means you need to pay rental income tax on the rent you earn. Income tax is a tax payable on all income. If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from.

Rental and Expense Worksheet Fact Professional

House Rent Deduction For Income Tax The rent that you receive from renting out your property in singapore may be subject to income tax. This means you need to pay rental income tax on the rent you earn. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). Income tax is a tax payable on all income. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation. The rent that you receive from renting out your property in singapore may be subject to income tax. But before you decide to rent out your home, it’s important to. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses.

From investguiding.com

Investment Expenses What's Tax Deductible? (2024) House Rent Deduction For Income Tax In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). But before you decide to rent out your home, it’s important to. This means you need to pay rental income tax on the rent you earn. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be. House Rent Deduction For Income Tax.

From manassasparkhomesforrentgenbura.blogspot.com

Manassas Park Homes For Rent Rent Deduction On Taxes House Rent Deduction For Income Tax But before you decide to rent out your home, it’s important to. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. This means you need to pay rental income tax on the rent you earn. The rent that you receive from renting out your property in singapore may be subject to. House Rent Deduction For Income Tax.

From teacherharyana.blogspot.com

House Rent Allowance (HRA) receipt Format for tax Teacher House Rent Deduction For Income Tax But before you decide to rent out your home, it’s important to. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. Income tax is a tax payable. House Rent Deduction For Income Tax.

From db-excel.com

Rental House Expenses Spreadsheet intended for Property Expenses House Rent Deduction For Income Tax In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation. This means you need to pay rental. House Rent Deduction For Income Tax.

From www.scribd.com

House Rent Allowance (HRA) What Is House Rent Allowance, HRA House Rent Deduction For Income Tax If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation. The rent that you receive from renting out your property in singapore may be subject to income tax. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). Salaried individuals who live in a rented. House Rent Deduction For Income Tax.

From www.slideshare.net

TaxDeductionChecklist House Rent Deduction For Income Tax Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. The rent that you receive from renting out your property in singapore may be subject to income tax. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses.. House Rent Deduction For Income Tax.

From www.taxscan.in

Rental received from letting out property is taxable under head House Rent Deduction For Income Tax This means you need to pay rental income tax on the rent you earn. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. If you do not receive hra from your employer and make payments towards. House Rent Deduction For Income Tax.

From blog.saginfotech.com

Tax Deduction on House Rent U/S 80GG Without HRA for Employees House Rent Deduction For Income Tax Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. The rent that you receive from renting out your property in singapore may be subject to income tax. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses.. House Rent Deduction For Income Tax.

From mavink.com

Sample House Rent Receipt For Tax House Rent Deduction For Income Tax Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation. The rent taxation in singapore for individuals is based on the net rental income after deducting. House Rent Deduction For Income Tax.

From www.pinterest.com

How to Deduct Property Taxes On IRS Tax Forms Irs tax forms, Mortgage House Rent Deduction For Income Tax The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. Income tax is a tax payable on all income. But before you decide to rent out your home, it’s important to. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or. House Rent Deduction For Income Tax.

From standard-deduction.com

Standard Deduction Tax Ay 202122 Standard Deduction 2021 House Rent Deduction For Income Tax The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be fully or partially exempt from. This means you. House Rent Deduction For Income Tax.

From fincalc-blog.in

HRA Exemption Calculator in Excel House Rent Allowance Calculation House Rent Deduction For Income Tax This means you need to pay rental income tax on the rent you earn. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). But before you decide to rent out your home, it’s important to. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be. House Rent Deduction For Income Tax.

From www.youtube.com

80GG House Rent deduction with Form 10BA of tax Act CA Mohit House Rent Deduction For Income Tax This means you need to pay rental income tax on the rent you earn. The rent that you receive from renting out your property in singapore may be subject to income tax. But before you decide to rent out your home, it’s important to. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). The. House Rent Deduction For Income Tax.

From vakilsearch.com

What is HRA and its Exemption and its Tax Deduction? House Rent Deduction For Income Tax This means you need to pay rental income tax on the rent you earn. Income tax is a tax payable on all income. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. The rent that you receive from renting out your property in singapore may be subject to income tax. Salaried. House Rent Deduction For Income Tax.

From www.template.net

Rent Receipt 26+ Free Word, PDF Documents Download House Rent Deduction For Income Tax The rent that you receive from renting out your property in singapore may be subject to income tax. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). This means you need to pay rental income tax on the rent you earn. If you do not receive hra from your employer and make payments towards. House Rent Deduction For Income Tax.

From studycafe.in

House Rent exceeds Rs. 1 Lakh; Submitting proof of rent compulsory to House Rent Deduction For Income Tax Income tax is a tax payable on all income. This means you need to pay rental income tax on the rent you earn. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. Salaried individuals who live in a rented house can claim this exemption and bring down their taxes.hra can be. House Rent Deduction For Income Tax.

From www.cnbc.com

A big tax break could be yours, just by renting out a room in your House Rent Deduction For Income Tax But before you decide to rent out your home, it’s important to. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. In a salaried individual's compensation package, one crucial element is the house rent allowance (hra). The rent that you receive from renting out your property in singapore may be subject. House Rent Deduction For Income Tax.

From dl-uk.apowersoft.com

Printable Tax Deduction Cheat Sheet House Rent Deduction For Income Tax This means you need to pay rental income tax on the rent you earn. But before you decide to rent out your home, it’s important to. The rent taxation in singapore for individuals is based on the net rental income after deducting allowable expenses. Income tax is a tax payable on all income. In a salaried individual's compensation package, one. House Rent Deduction For Income Tax.